Alternative Currency for Oakland Residents and Neighbors

…An Oakland Merchant Credit System/ID as Local Currency…

BY WILSON RILES, JR

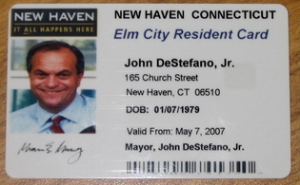

A number of groups in Oakland are organizing around a residential ID card. The City and County of San Francisco has voted to implement one in August. The principle motivation of the San Francisco effort and those currently involved in the Oakland effort is to make more real the “sanctuary city” concept for the “undocumented.” It is believed that a City ID would provide the “undocumented” an official document that would be useful in many circumstances that you might imagine: opening bank accounts, verification for credit, resident identification for neighborhood security situations (the police departments generally support such efforts), etc.

In order for an ID card to be successfully implemented for such purposes, however, the card would also have to be of some value and use for those who are “documented” residents also. Otherwise, such an ID card would only be used by the undocumented and it would simply identify a person as an “illegal” and increase rather than decrease vulnerability. This is the experience with the Consular Cards distributed by the Mexican government. Consequently, in San Francisco they are considering having the ID card there also function as a discount card for some City services such as libraries, zoos, and public transportation. Note that San Francisco, being a City and a County, has direct control over more of these kinds of public services than Oakland does. In San Francisco, some are also thinking of incorporating a prepaid credit card into their ID.

I think that Oakland can do better than that by fashioning a card that would be of great benefit to all the residents of Oakland. Only a narrow slice of the resident population uses the zoo, the libraries, and other local services in the control of City government. It is not the cost that keeps most Oakland residents away from these services; it is interest and the availability of alternatives activities that they can also afford. In addition, only a slice of the low-income resident population bothers with discount cards or prepaid credit cards. Most folks really do not need another credit card option. My suggestion is that we address the roots of one of Oakland’s most intractable problems: totally permeable economic membranes.

My suggestion is that we combine the ID concept with the concept of a local currency. You could title this either a “merchant credit system” or a local, virtual, Alternative Currency for Oakland Residents and Neighbors (ACORN). In other words, we would call that local currency the “ACORN.” This captures a local prosperity/growth concept for the currency. The United States has a rich history of local currencies. [If you are not aware of this, check out – for example – the following web site: http://www.schumachersociety.org/local_currencies/currency_groups.html. There are local currencies in Ithaca (N.Y.), Berkshire (Mass.), Humboldt (CA.), Lawrence (Kansas), Floyd (Virginia), Calgary (Canada), and many more places in this country and around the world. There are more references at the end of this piece.]

The “big boys” use currency trading not only to hedge against inflation and trade fluctuations but also to amass assets; a local currency would make some of those options available to the City of Oakland and the “little guy.” An additional important benefit is to keep more resources within the micro-economy of the City. Currently Oakland has the lowest “multiplier rate” of any city in the Bay Area; that means that the money that flows into Oakland “turns over” very few times before it flows out into other communities. Local currency significantly increases the “multiplier rate.”

Past attempts to address this problem included attempting to have more City employees live in Oakland, thus expecting them to spend the public dollars from their paychecks in Oakland. [The State constitution does not allow Oakland – unlike some cities in eastern states – to require employees to live in the boundaries of the City.] Oakland has discussed using incentives to achieve this local residency of City employees. The City also instituted various weak “hire Oakland” programs. We have made major efforts to attract major retail outlets hoping to capture more of the retail dollar that leaks outside of our community; for many reasons this has not worked well enough either. [Part of this problem is the lack of resources and attention that is paid to small local businesses: the business sector that has proven the most capable of benefiting and benefiting from local prosperity.] Local merchants’ groups struggle with the City to promote Oakland businesses’ buy-local advertising programs. Some local merchants are currently considering a pre-paid VISA card to promote the Oakland “brand;” the ACORN ID-currency card has many advantages over this pre-paid credit card idea.

Oakland’s attempts at attracting meeting/convention business and tourism has also had limited benefits because tourists simply take BART over to San Francisco to spend their money. If Oakland does not correct for this problem, no amount of convention business, housing development, or office development will improve our local economic situation very much over all. I think that the development of a local currency will be of immediate help. In the tourist business for example, the City, hotels, or visitor sites, as a promotion, could give tourists ACORNs to stimulate their expenditures in Oakland.

In addition, one of the largely unspoken criticisms of the “undocumented” is the millions of dollars that they send to their home country (remittances) that are taken out of the economies of local communities. [This criticism does not take into account the money immigrants spend in the community that might not happen if they were not present to do the work at the compensation levels that are offered.] If the work of employees in Oakland were compensated – at least in part – in ACORNs (accepted for goods and services by Oakland restaurants, retail stores, etc.), this would be a huge boost to Oakland’s economy – producing more local jobs and allowing higher salaries in the local services economy. More of the income earned in Oakland would stay in Oakland. This would tremendously increase the “multiplier effect.”

In San Francisco, the I.D. ordinance attempts to respond to the need that more individuals than the “undocumented” should have these ID cards to make them effective by allowing them to be used as discount cards at libraries, the zoo, the golf course, and for transportation on Muni. Oakland would tap into a larger number of activities by making the ID card also function as local currency. Dr. Raul Hinojosa of UCLA estimates a huge multibillion dollar development potential by working more justly with immigrant residents. Oakland could tremendously boost the local micro economy by paying City employees partially in ACORNs (giving them an ACORN credit/ID card). If just 10% of City employees’ pay were paid in equivalent ACORNs, the current budget deficit of approximately $30 million dollars would be covered and approximately $30 million dollars would be injected into Oakland’s local economy, guaranteed. This would lessen the pressure to lay-off needed City employees.

If the City accepts ACORNs for the payment of parking fees, fines, business licenses, development fees, etc., this will facilitate the circulation of the ACORN in Oakland. The City could encourage the hiring of Oakland residents and many other things by encouraging businesses and others to accept ACORNs and by giving them a cut in costs if they pay by ACORNs. The City would lose little since the greatest economic problem in Oakland is the loss of the economic “multiplier effect” that will be corrected using the ACORN cards.

With the participation of a local bank or financial institution, a magnetic-strip card that could be used in the current card reader technology could be easily implemented. This bank or financial institution would also be able to provide currency exchange services with US dollars as well as with the currency of other cities and other countries. This includes exchanges with the Native American reservations associated with the significant population of people from indigenous tribes that live in Oakland; Oakland has one of the highest concentrations of indigenous people west of the Mississippi. Most of the accounts (checking and savings) of the previously undocumented would probably be placed at this institution in addition to the processing of remittances. City and School District employees will want to open up other accounts in the financial institution that also has their ACORN account. The People’s Community Partnership Federal Credit Union has shown interest and is researching regulatory restrictions. This program is in agreement with their corporate mission.

In addition, local currency would encourage intra-Oakland business-to-business commerce. This would benefit the small and people-of-color businesses in Oakland more than the chains, thus stimulating more local ownership success. Businesses, which “got on board” with this early, would have “a leg up” on lagging businesses in competing for these resources.

The Hass School of Business at UC Berkeley, and business schools and economic departments from Stanford, Mills College and other nearby education institutions could constitute an Oakland ACORN “Reserve Board” to monitor and control the ACORN currency for the benefit of Oakland residents. The “Reserve Board” would also be responsible for the financial education of resident adults and youth. The study of the workings of the local currency could be beneficial to our youth to learn and understand economics at a deeper level than most. The participation of the School District in this educational effort as well as in compensating Oakland teachers – at least partially – in ACORNs would give a huge boost to the success and prosperity of the community. Oakland could truly become a “model city” in every way, including through its economic system and its educational system. Members of the Oakland Unified School District Board are currently considering this proposal.

There may even be uses for the local currency to benefit Oakland’s international trade position, as the fifth largest port in the U.S. Traders may – at times – want the option to denominate their trade to the U.S. in a currency other than the U.S. dollar. In addition, because of the hugely diverse international resident population in Oakland, establishing currency exchange rates with other countries would facilitate more small businesses and local residents getting involved in the international trade business. Making true what I think Oakland’s permanent slogan ought to be, Oakland, Home to the World.

[For questions, comments, additional references, or to offer support please contact the following:

Wilson Riles, wriles@pacbell.net, 510-530-2448.]

References:

Rethinking Our Centralized Monetary System: The Case for a System of Local Currencies http://books.google.com/books?hl=en&lr=&id=8VRKVwP4JMsC&oi=fnd&pg=PP7&dq=city+local+currencies&ots=oIqQVYSHkI&sig=azTE8a6NUvR03mjzYOvScAnzEG0 The Signalling Role of Municipal Currencies in Local Development http://www.blackwell-synergy.com/doi/abs/10.1111/j.1468-0335.2005.00434.x No Single Currency Regime is Right for All Countries or At All Times http://www.nber.org/papers/W7338.pdf Alternative Currency Movements As a Challenge to Globalization? http://books.google.com/books?hl=en&lr=&id=9rfJSnZh-T0C&oi=fnd&pg=PP11&dq=alternative+city+currency&ots=izy9pxpK78&sig=A5cxvUHEa9PQFTqb987qjwuc0YE Building Localized Economies as a Response to Globalization? http://www2.warwick.ac.uk/fac/soc/csgr/activitiesnews/conferences/2005_conferences/8_annual_conference/north.doc Community currency in the United States: the social environments in which it emerges and survives http://www.envplan.com/abstract.cgi?id=a37172

Hi Wilson, This is awesome! I am totally blown away by this project! Thank you for all you’ve done and are doing! I feel very fortunate that our paths crossed at the local currency meeting today! I added this page’s blog to my RSS reader. I hope you will join the Transition East Bay ning networking site, so that you can be in more connection with others who are interested in local currency, and community building. Judith

Very sensible and practical proposal.

Here’s my

Recipe for Successful Community Currency

Printing local money sets the table for a feast provided by your city or town. Here are my suggested ingredients for spicing local trade with local cash.

1. HIRE A NETWORKER. During the past 15 years, nearly 100 American community currencies have come and gone. Ithaca’s HOURS became huge because, during their first eight years, they could rely on a full-time Networker to constantly promote, facilitate and troubleshoot circulation. Lots of talking and listening.

Just as national currencies have armies of brokers helping money move, local currencies need at least one paid Networker. Your volunteer core group– your Municipal Reserve Board– may soon realize that they’ve created a labor-intensive local institution, like a food co-op or credit union. Playing Monopoly is easier than building anti-Monopoly.

Reduce your need to pay the Networker with dollars, by finding someone to donate housing. Then find others to donate harvest, health care, entertainment.

2. DESIGN CREDIBLE MONEY. Make it look both majestic and cheerful, to reflect your community’s best spirit. Feature the most widely respected monuments of nature, buildings, and people. One Ithaca note celebrates children; another displays its bioregional bug. Use as many colors as you can afford, then add an anti-counterfeit device. Ithaca has used local handmade paper made of local weed fiber but recently settled on 50/50 hemp/cotton. Design professionally– cash is an emblem of community pride.

3. BE EVERYWHERE. Prepare for everyone in the region to understand and embrace this money, such that it can purchase everything, whether listed in the directory or not. This means broadcasting an email newsletter, publishing a newspaper (at least quarterly), sending press releases, blogging, cartooning, gathering testimonials, writing songs, hosting events and contests, managing a booth at festivals, perhaps a cable or radio show. Do what you enjoy; do what you can.

By 1999, Ithaca HOURS became negotiable with thousands of individuals and over 500 businesses, including a bank, the medical center, the public library, plenty food, clothes, housing, healing, movies, restaurants, bowling. The directory contained more categories than the Yellow Pages. We even created our own local nonprofit health insurance.

Imagine millions of dollars worth circulating, to stimulate new enterprise, as dollars fade.

4. BE EASY TO USE. Local money should be at least as easy to use as national money, not harder. No punitive “demurrage” stamps– inflation is demurrage enough. No expiration dates– inspire spending instead by emphasizing the benefits to each and all of keeping it moving. Hungry people want food, not paper, so hard times can speed circulation.

Get ready to issue interest-free loans. The interest you earn is community interest– your greater capability to hire and help one another. Start with small loans to reliable businesses and individuals. Make grants to groups.

5. BE HONEST AND OPEN. All records of currency disbursement are displayed upon request. Limit the quantity issued for administration (office, staff, etc) to 5% of total, to restrain inflation

6. BE PROUDLY POLITICAL. Local folks from all political backgrounds find common ground using local cash. But local money is a great way to introduce new people to the practicality of green economics and solidarity. I enjoyed arguing with local conservatives, then shaking hands on the power we both gain trading our money. Hey, we’re creating jobs without clearcutting, prisons, taxes and war!

You can make it likelier that your money is spent for grassroots eco-development by publishing articles that reinforce these values. By contrast with global markets, our marketplaces are real places where we become friends, lovers, and political allies.

Glover teaches at Temple University, and consults for

community economic development. paulglover.org

Pingback: Green Jobs Philly NEWS #15 | Green Jobs Philly News

Pingback: Oakland municipal ID cards back at Council : A Better Oakland

Pingback: Oakland’s own currency? Mayoral candidates aren’t buying it, yet – Oakland North -- North Oakland News, Food, Art and Events.

“Currently Oakland has the lowest “multiplier rate” of any city in the Bay Area-” do you have research to back this up? I would be interested in evidence to this effect.

Thank you.

Bruce

We need to recognize that monetary systems reflect specific values and that _real_ free market competition includes complementary currencies that reflect different values. Our usury based dollars value speculation too heavily at the expense of people who wish to pursue other goals. Those who enjoy the game of wealth building and leverage this currency which is expected to grow in value and provide a positive rent/interest are well served by this system. The problem is we are all captive to this winner take all game & the currency is rigged against those who would prefer to put their energies to other purposes (and hire the wrong financial adviser). There is a reason that 90% of the wealth has migrated into the hands of less than 5% of the people. This is because the money flows are set up to move the money to the people who receive more interest than they pay from the larger population of people who are paying more interest than they receive. As this money pools into fewer hands the velocity slows, particularly at times like this when large speculative bubbles need time to unwind. A currency with a small ‘holding fee’ (a demurrage fee, negative interest rate, or a ‘flat tax on currency’ – however you’d like to frame it) is designed to increase the velocity of money and diminish its value as a speculative instrument.

Money has been defined as having 3 functions: a unit of value, a medium of exchange, and a store of value. The last 2 functions have contradictory effects in how the money flows thru society & we need a currency that favors “medium of exchange” and will continue to function during downturns like this one. Having a currency designed specifically to address the function of ‘medium of exchange’ is an important part of the ecology of healthy economic exchange. One good example is the CHIEMGAUER (http://www.ijccr.net/IJCCR/2009_%2813%29_files/IJCCRvol13%282009%29pp61-75Gelleri.pdf) in Austria, which is a demurrage currency having a small ‘holding fee’ attached to boost the velocity of the money. If local governments issued demurrage currencies to fund the local bond issues people vote for, then they could spend the currency into circulation on the social infrastructure like teachers, police and fire departments. This democratizes the credit commons as Thomas Greco recommends (rather than borrowing dollars at interest). During the last depression this was tried very successfully in Worgl (see minute 2 of this 4 minute video http://www.youtube.com/watch?v=hxdPIOUTd2k).

Money is a great invention – but our role in society changed when we evolved from an agrarian culture into modern urban life. With mass production of products and ever denser populations it’s no longer possible for individuals to make most of the things required to survive in an urban environment. Economists have been clear about the value of this ‘specialization of skills & knowledge’ on the increased wealth in our society. But there has not been a fair bargain made for all the people who forfeit their self sufficiency to live in this interdependent culture. This is the reason that billions of dollars are paid to the financial leaders who make the investment instruments that take the world to the brink of collapse while the skilled tradesmen are a dying breed.

I disagree with Paul Glover’s comment about demurrage currency above.

Demurrage currencies promote long term thinking by imposing the same ‘storage fee on currency’ that real assets have. Positive interest rate amounts to preferring short term gains since returns on long term projects are exponentially discounted to present value. Demurrage currencies have the opposite effect, it’s much more profitable to spend them on productive long term projects.

As a practical matter, local currency needs to become at least as easy to use as dollars. The theory of demurrage is, I believe, more appealing than its real world impact. Threatening people with loss of value, requiring cumbersome affixing of stamps, or requiring replacement of expired notes, or extinguishment of electronic credits, give local money a bad name. Inflation is already demurrage, an incentive to spend. But the best incentives are positive– the enjoyment of local trade. Stimulating preference for relying on local money is an essential cultural challenge.

Just my opinion. If you create a community currency, impose demurrage, and make it work in our more instant gratification culture, I’m willing to adjust based on your success.

Pingback: Progressive Opportunities Conference: FEBRUARY 26, 2012

Pingback: Oakland Greens Propose an Oakland Progressive Alliance « Alameda County Green Party Blog

Maybe money is the problem? Why should everyone be subjected to MORE documentation? Unfortunately, this sounds like a way to more easily control the public. It sounds like the beginning of the NWO. This is one of the things they are supposed to try to convince the public is necessary. It makes not a lot of sense for each city to implement their own currency–it seems like it’s making traveling right next door kind of a hassle. Especially as money only has as much value as we “say”. Couldn’t we just “say” money was valueless, therefore, if you are going to “say” some alternative cash can be used there?

Liz, it is understandable that you would see money only in the form that serves the imperialism. Like fire money was “invented” ages ago and has had many forms. I would suggest you read Bernard Lietaer, author of The Future of Money (translated in 18 languages). He talks about money’s history and some of the new forms of money that is not exploitative that is happening all over the world. The ACORN is such a currency and it can be easily exchanged with local currencies of other communities because it is electronic.